We’ve all been there: it’s the end of a fantastic meal, the check has arrived, and suddenly everyone has a headache from trying to split the bill. You know there’s an easier way, you just haven’t adopted it yet. That’s where mobile payment comes in.

And though the idea of a digital wallet is increasingly commonplace, you may still be searching for the peer-to-peer platform (P2P) best suited to your financial needs.

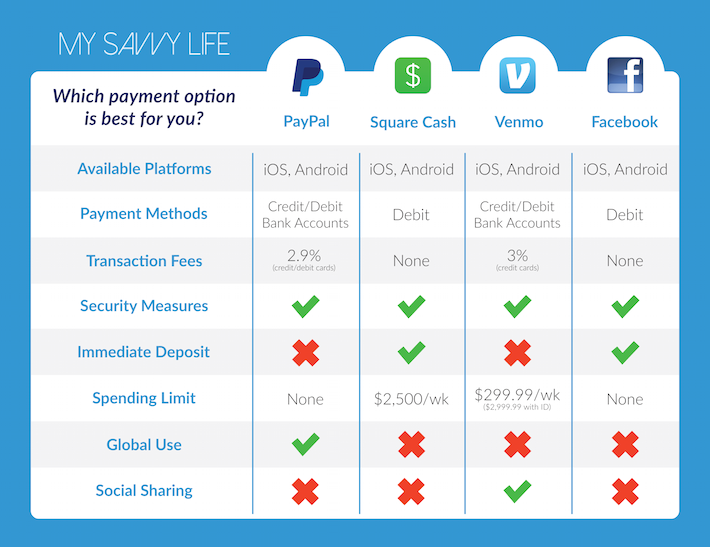

Whether you have to send money across the globe, or simply want to share payment updates with friends, there are several applications to choose from. The top four P2P platforms — PayPal, Square Cash, Venmo, and Facebook (recently added) — all provide essentially the same service, but their individual functionalities and limitations are worth exploring. Which one is right for you?

Let’s take a look at the basics first. All four of these apps work on iOS and Android, as well as via Web browsers. None of these apps requires NFC (near field communication) technology in your phone; all you need is a connection to the Internet. Setting up each app only takes a couple of minutes to add in your personal information.

Next, you never want to be that person that requires everyone to download an app they aren’t likely to use again. If you were to take a look at the number of users, PayPal’s app has 165 million active users globally and now that Facebook has recently entered the game, this could be a game-changer for these apps.

Privacy is also key in your decision. All four options provide excellent ways to verify your identity, but yet, they are all different. With iOS, they can verify your identity with Apple’s Touch ID, the iPhone’s built-in-fingerprint tool, every time you use them, giving you an extra layer of in-app security. Venom requires multifactor authentication if you sign up for the service on one device and then try to use it on another. PayPal confirms your identity using various security questions, and all apps can send authentication codes to your mobile device to make sure you are who you say you are.

To further compare these apps, take a look at the chart to find out which option works best for you. Mobile payments are becoming the simplest cash alternative, but also finding one that fits your needs, is of the upmost importance.